European VAT number PrestaShop Free Download module is a powerful tool for businesses engaged in B2B commerce. It allows you to check your customers’ VAT numbers, limit VAT scams, invoice tax-free foreign professionals whose VAT number is valid on VIES (the official European website for checking the validity of VAT numbers), and benefit from an accounting report.

With this European VAT number PrestaShop Nulled, you can ensure a flawless verification of VAT numbers by integrating with the VIES system. The VIES system provides an official platform for checking the validity of VAT numbers across Europe. By verifying VAT numbers, you can prevent fraudulent activities and limit potential losses.

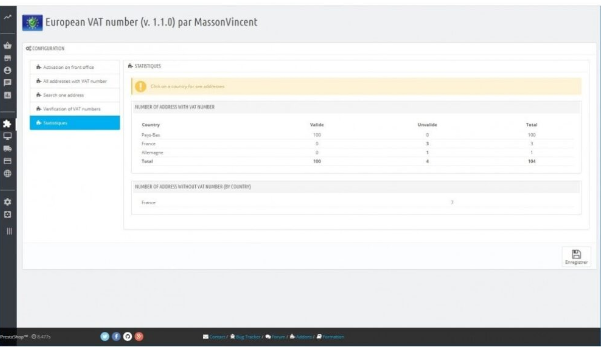

The module also offers an overview of addresses with VAT numbers, allowing you to manually validate VAT numbers if the VIES system is temporarily inaccessible. You can easily modify or delete VAT numbers if needed. The system helps you maintain accurate and updated VAT number records, ensuring that your database only contains valid and reliable information.

One of the significant advantages of this module is the ability to invoice tax-free foreign professional customers with a valid intra-community VAT number. This feature streamlines the billing process for international customers, allowing them to avoid the hassle of VAT returns and enabling quicker recovery of their VAT.

By using this module, you can safeguard your business against scams by individuals who may try to manipulate VAT Numbers Nulled or provide false information. It helps you identify and detect false or erroneous VAT numbers, ensuring that you only engage in legitimate transactions with trusted customers.

Furthermore, the module provides an accounting report that allows you to analyze sales and track the profitability of individual products. This feature enables you to gain valuable insights into your business’s financial performance and make informed decisions based on accurate data.

Overall, the VAT Number Verification Free Download module offers several benefits for businesses engaged in B2B commerce. It simplifies the billing process for tax-free international transactions, protects against VAT scams, ensures data accuracy, and provides valuable accounting reports for analyzing sales performance.